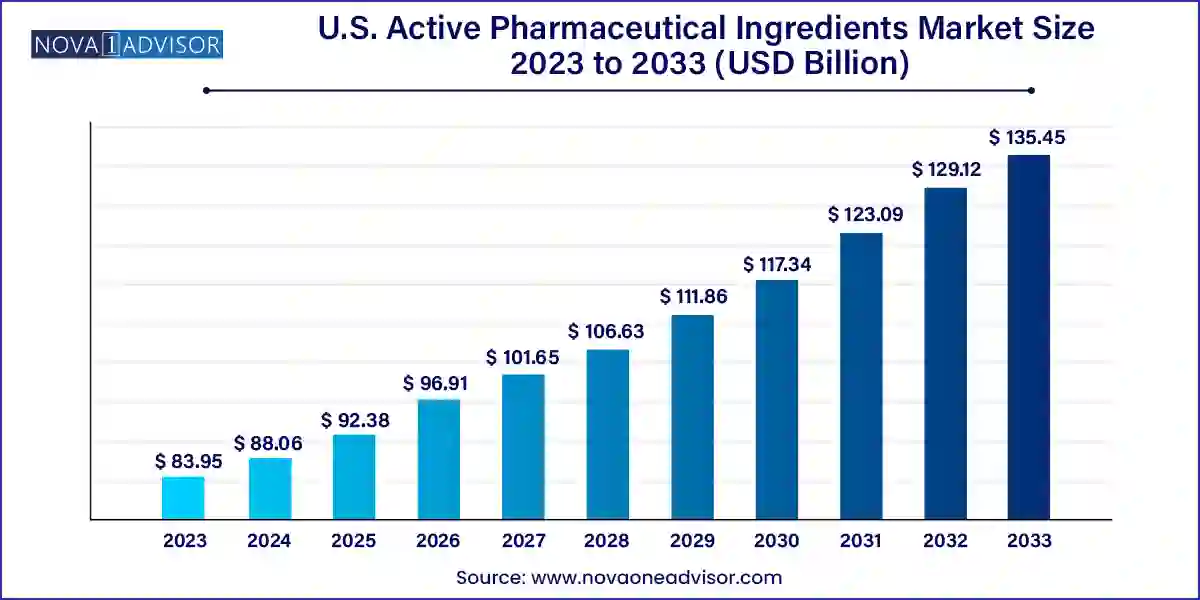

The U.S. active pharmaceutical ingredients market size was valued at USD 83.95 billion in 2023 and is anticipated to reach around USD 135.45 billion by 2033, growing at a CAGR of 4.9% from 2024 to 2033.

The U.S. Active Pharmaceutical Ingredients (API) market stands as a critical pillar of the country’s pharmaceutical sector. APIs form the core components of any drug, determining the therapeutic efficacy and mechanism of action. The market encompasses a vast array of substances used in various treatment areas ranging from cardiovascular and neurological diseases to cancer therapies and endocrine disorders. The increasing demand for high-quality healthcare solutions, rising prevalence of chronic illnesses, and the country’s robust pharmaceutical infrastructure are driving the growth of the API sector.

Historically, the U.S. has relied heavily on international API sources, especially from China and India, due to cost advantages. However, the COVID-19 pandemic exposed vulnerabilities in global supply chains, prompting both federal initiatives and private investments to bolster domestic API production. This has led to renewed focus on pharmaceutical manufacturing self-sufficiency and quality control. The market is further boosted by the growth of specialty drugs, rising generic drug adoption, and a strong emphasis on biologics and biosimilars.

Moreover, U.S. regulatory authorities such as the FDA impose strict guidelines on drug manufacturing, reinforcing the need for compliance and high-quality APIs. Companies are increasingly investing in Research and Development (R&D) for innovative drug formulations, biosynthetic routes, and more efficient, scalable manufacturing techniques, particularly in biologics. The digitalization of manufacturing workflows and advanced technologies such as continuous manufacturing and Process Analytical Technology (PAT) are being gradually adopted to ensure real-time quality assurance and cost-efficiency.

Reshoring of API Manufacturing: The U.S. is actively encouraging local API production to reduce reliance on foreign sources, driven by concerns over supply chain resilience and drug security.

Growth of Biotech APIs: Increasing prevalence of complex diseases and rising adoption of biologics is accelerating demand for biotech APIs such as monoclonal antibodies, peptides, and recombinant proteins.

Investment in Continuous Manufacturing: Pharmaceutical companies are transitioning from batch production to continuous manufacturing, improving operational efficiency, cost savings, and product quality.

Integration of AI and Machine Learning: Drug manufacturers are incorporating AI and ML into API development for predictive modeling, optimization of synthesis routes, and failure prevention.

Surge in Generic Drug Development: As numerous blockbuster drugs lose patent protection, generic APIs are witnessing increased production and investment, driving affordability in healthcare.

Green Chemistry and Sustainable Manufacturing: Environmental concerns and regulatory scrutiny have led to the development of eco-friendly synthesis processes that minimize waste and energy use.

Mergers and Acquisitions: The U.S. API market is witnessing strategic collaborations, acquisitions, and partnerships, enabling players to expand portfolios, geographic reach, and technological capabilities.

| Report Attribute | Details |

| Market Size in 2024 | USD 88.06 Billion |

| Market Size by 2033 | USD 135.45 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 4.9% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Types of synthesis, types of manufacturers, types, and application |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled | AbbVie Inc.; Viatris Inc.; Fresenius Kabi AG.; Curia.; Pfizer Inc. (Pfizer Center One); Bristol-Myers Squibb Company; Catalent, Inc.; Ampac Fine Chemicals (AFC); Amgen Inc.; Johnson & Johnson |

One of the most influential growth drivers of the U.S. API market is the rising burden of chronic diseases such as diabetes, cardiovascular disorders, cancer, and neurological ailments. According to the CDC, six in ten adults in the U.S. have a chronic disease, and four in ten have two or more. This alarming statistic significantly boosts the demand for both innovative and generic drug formulations, thereby elevating the need for a diversified API portfolio.

For instance, the high prevalence of cardiovascular diseases has sustained demand for APIs such as Atorvastatin and Losartan. Meanwhile, the oncology segment has witnessed increased production of APIs used in immunotherapy and targeted therapies. This trend is not only influencing large-scale API manufacturers but is also encouraging startups to develop specialized molecules tailored to precision medicine.

Despite its potential, the U.S. API market is encumbered by rigorous regulatory oversight that can be both time-consuming and costly. The U.S. Food and Drug Administration (FDA) enforces strict Current Good Manufacturing Practices (cGMP) to ensure safety and efficacy. While these regulations enhance drug quality and public health, they also raise entry barriers for small and mid-sized players.

Obtaining facility approvals, maintaining audit readiness, ensuring data integrity, and addressing the complexities of dual inspections for APIs intended for both domestic and export use require substantial investment in quality control systems. Delays in approvals, recalls due to quality issues, and increased compliance costs can impact operational profitability and slow market penetration.

A significant opportunity lies in the growing adoption of advanced manufacturing technologies in biotech API production. Biotech APIs, often derived from living cells or recombinant DNA technology, require sophisticated bioprocessing setups. The U.S., with its high concentration of biotechnology companies and research institutions, is well-positioned to lead innovation in this space.

The rise of cell and gene therapies, monoclonal antibodies, and mRNA-based treatments has propelled demand for cutting-edge biomanufacturing solutions. Companies that invest in scalable bioprocessing systems, single-use technologies, and integrated quality monitoring tools are expected to capture a significant share of the biotech API market. Additionally, partnerships between API producers and academic institutions for biotechnological innovations are paving the way for next-generation therapeutics.

Oncology is the leading application segment in the U.S. API market. The high prevalence of various cancers such as breast, lung, and colorectal cancer, along with ongoing research in immunotherapy and targeted drug development, is driving API consumption. APIs used in anti-cancer drugs often require high-potency manufacturing capabilities, prompting investments in high-containment facilities.

Central Nervous System (CNS) and neurology applications are expected to grow at the fastest pace. Rising cases of Alzheimer’s disease, epilepsy, depression, and Parkinson’s disease have led to heightened focus on CNS drug development. Innovative drug delivery systems, extended-release formulations, and novel molecular targets are shaping the demand for APIs in this therapeutic area.

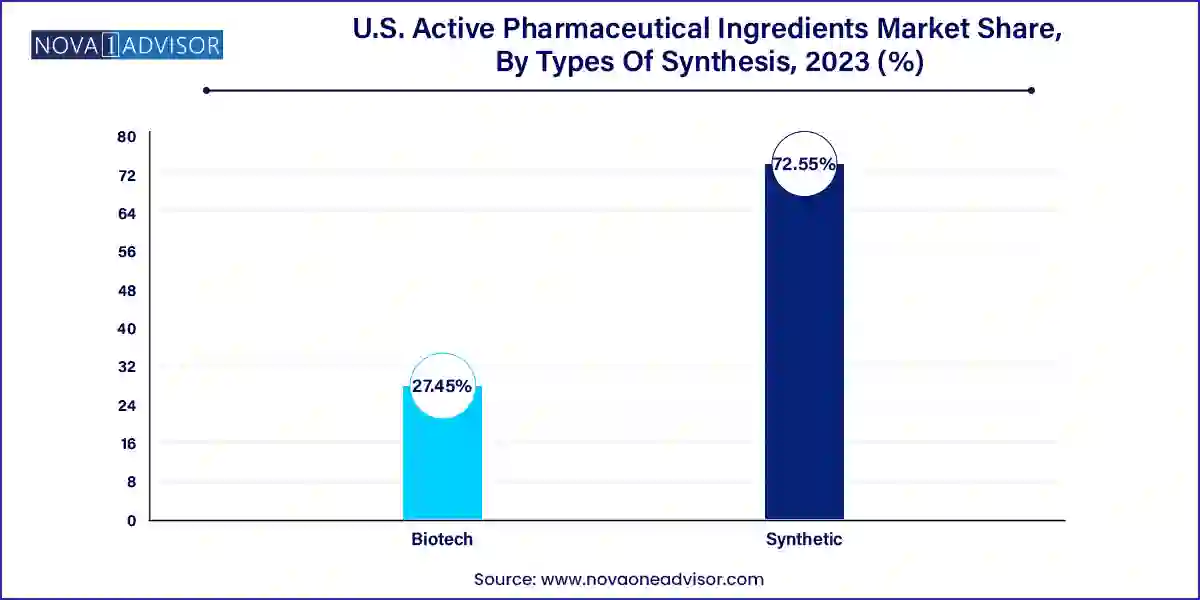

Synthetic APIs dominated the U.S. API market in 2023 due to their widespread use in generic drug formulations and ease of production. These APIs, synthesized through chemical reactions, are integral to medications across multiple therapeutic areas. They are particularly favored for their cost-effectiveness and consistent scalability. A well-established knowledge base and manufacturing infrastructure in the U.S. further fuel their dominance.

However, biotech APIs are expected to be the fastest-growing segment during the forecast period. With the surging adoption of biologics and targeted therapies, biotech APIs such as recombinant proteins, vaccines, and monoclonal antibodies are gaining momentum. These APIs offer highly specific therapeutic action with minimal side effects, making them especially valuable in oncology and autoimmune disease treatment. The U.S. biotech landscape, backed by strong academic research and funding, is nurturing innovative solutions that require advanced API production techniques.

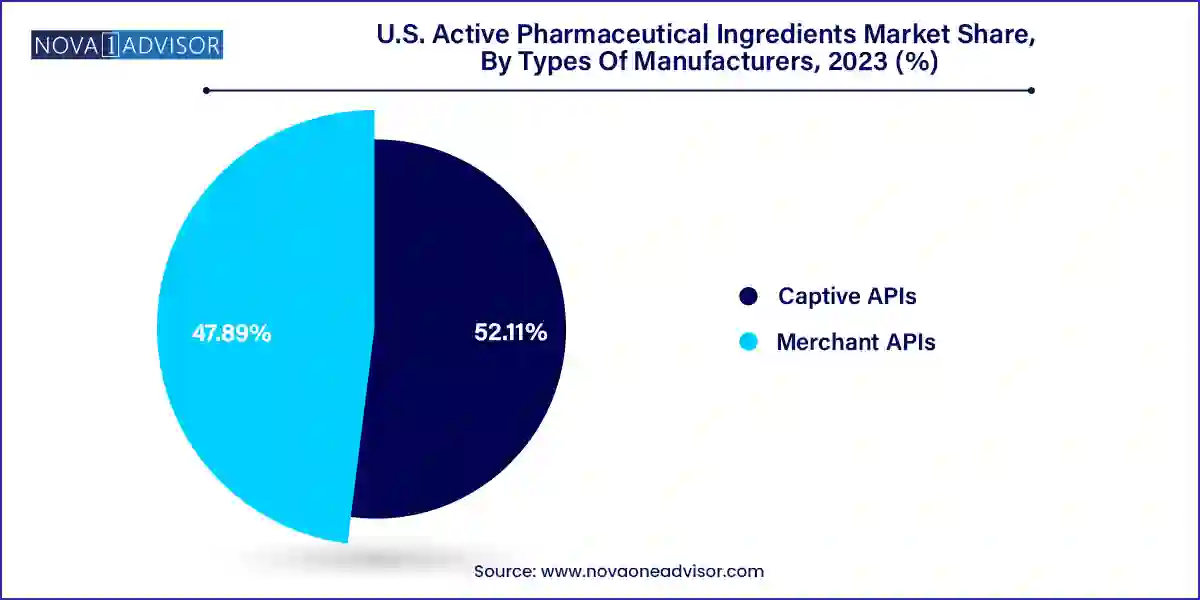

Captive API manufacturing currently holds the largest market share in the U.S., supported by the integration of API production within pharmaceutical companies. Captive models enable full control over the supply chain, quality assurance, and intellectual property protection. Major pharma companies like Pfizer and Johnson & Johnson leverage in-house API production to meet both clinical and commercial demands efficiently.

Merchant APIs are projected to witness the highest growth rate in the coming years. This is attributed to the growing trend of outsourcing and increasing demand for cost-efficient production, particularly among smaller pharma and biotech firms. Merchant API providers are investing in high-capacity manufacturing, compliance excellence, and innovation in continuous production, which are becoming increasingly attractive to formulators seeking supply chain agility.

Generic APIs currently dominate the U.S. market due to patent expirations and the healthcare system's strong push for affordable treatments. Government programs like Medicaid and Medicare, along with pharmacy benefit managers, often favor cost-effective alternatives, further boosting generic API demand. Players such as Teva Pharmaceuticals and Mylan are heavily invested in generic drug production.

Meanwhile, innovative APIs are set to grow rapidly, fueled by personalized medicine and the rise of orphan drugs targeting rare diseases. These APIs often involve novel mechanisms of action and complex molecular structures, necessitating specialized R&D and regulatory approvals. With the increasing number of FDA-approved New Chemical Entities (NCEs), innovative API production is projected to see a marked expansion.

The U.S. stands as a global leader in pharmaceutical innovation, and its API market is characterized by technological sophistication, high-quality standards, and regulatory robustness. The federal government has recognized the strategic importance of securing API supply chains, leading to policy support and grants aimed at encouraging domestic API manufacturing.

In May 2020, the Biomedical Advanced Research and Development Authority (BARDA) awarded $354 million to Phlow Corporation to manufacture essential APIs in the U.S. This marked the beginning of several initiatives focused on re-establishing domestic capabilities. Moreover, the U.S. Department of Defense and the Department of Health and Human Services have also provided funding to support API manufacturing under the Defense Production Act.

The country’s research ecosystem, powered by the NIH and academic institutions like Harvard and MIT, continues to contribute to the discovery of novel compounds and scalable synthesis methods. Public-private partnerships are further accelerating development in biologics, especially in the wake of COVID-19 where mRNA technology emerged as a game-changer.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. Active Pharmaceutical Ingredients market.

By Types of Synthesis

By Types of Manufacturers

By Types

By Application